In 2015 I had a tenant that wanted to sign a 2 year lease at my asking price of $1300/month. I like stability in my rentals, so I agreed. The first year he was a pretty good tenant. He would pay his rent on time, he would tell me when things needed fixing and he kept the place pretty clean. Overall, I was happy. The second year, everything seemed great as well, however the number of calls I received to fix things went down. “He must be doing a great job taking care of the place!”, I thought. Continue reading…

In 2015 I had a tenant that wanted to sign a 2 year lease at my asking price of $1300/month. I like stability in my rentals, so I agreed. The first year he was a pretty good tenant. He would pay his rent on time, he would tell me when things needed fixing and he kept the place pretty clean. Overall, I was happy. The second year, everything seemed great as well, however the number of calls I received to fix things went down. “He must be doing a great job taking care of the place!”, I thought. Continue reading…

What happened to my blog?

I was inspired to start a blog by other bloggers blogging about how you can easily make good money by starting a blog. Sounds good to me. I want a lifestyle where I can travel the world and make money while posting an article every once in a while. So what happened?

How To Juice Your Rental Property Returns

The rental market is a soft market. What I mean by that is there is no set market rental price like there is with commodities or the stock market. If “market rent” for your rental is $1,000/month, someone with a nearly identical property may be renting their property for $800/month and someone else might be renting their property for $1,200/month. Both will rent. The difference is, someone who is asking $800/month for their property will probably fill their property with tenants more quickly than someone who is asking $1,200/month for their property, assuming the properties are nearly identical. But the higher your asking price, the less likely you are to find tenants willing to pay your exorbitant price. What if I told you a way you can double your return on investment on your rental properties? Continue reading…

The rental market is a soft market. What I mean by that is there is no set market rental price like there is with commodities or the stock market. If “market rent” for your rental is $1,000/month, someone with a nearly identical property may be renting their property for $800/month and someone else might be renting their property for $1,200/month. Both will rent. The difference is, someone who is asking $800/month for their property will probably fill their property with tenants more quickly than someone who is asking $1,200/month for their property, assuming the properties are nearly identical. But the higher your asking price, the less likely you are to find tenants willing to pay your exorbitant price. What if I told you a way you can double your return on investment on your rental properties? Continue reading…

How Real Estate Can Make You A Millionaire

Buy as many properties as you can throughout your life and never sell them.

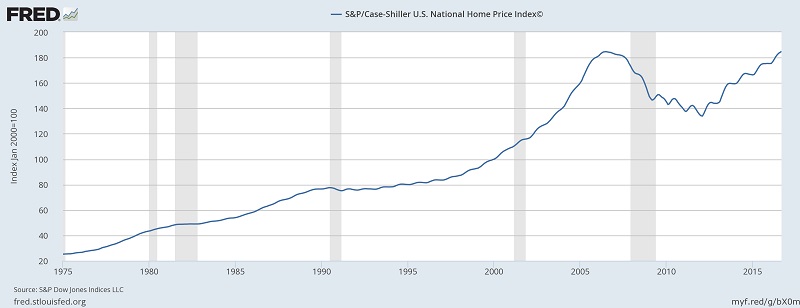

As you can see from the Case-Shiller US National Home Price Index, the real estate bubble and subsequent crash was an anomaly. Prior to that there were 30 years of sustained growth. Sure, local markets went up and down, but on a national average, prices steadily rose for 30 years. Even if you bought at the top in 2006 you would be back to even today. Your 30-year mortgage would be paid down by 20% and you would be sitting on a pile of equity. Had you bought steadily throughout your life, before, during, and after the bubble, and never sold, you could be a millionaire.

Follow my journey to see how buying properties consistently throughout life has turned me into a millionaire and see how you can become a millionaire too.

Sometimes Its Smart To Borrow From Your 401K

They say, “never borrow from your 401K”. Here is what happens when you do. Lets say you borrow $30,000 from your 401K. You’re borrowing pre-tax money so you don’t have to pay taxes on it when you borrow. However you have to pay it back with post-tax money. If you’re in the 25% tax bracket, you have to make $40,000 pre-tax to pay back the $30,000 loan into your pre-tax account. Note, for simplicity, I’m ignoring the 3.25% interest you have to pay yourself when paying back a 401K loan. By having to pay $40,000 to pay back the $30,000 you just borrowed, you’ve just been taxed $10,000 for that money. Now lets fast forward 10 or 30 years to when you retire early at 59.5 years of age. Now you can withdraw from your 401K without penalty. Lets say you need an additional $30,000 above your other income sources to cover your annual expenses. Your 401K is a pre-tax account, so to get $30,000 to pay your annual expenses you will need to withdraw $40,000 from your 401K. You will once again be taxed $10,000 on the money you withdraw, assuming you’re still in the 25% tax bracket. You’ve just been double taxed!!!

Continue reading…

Real Estate Crowdfunding for Non-Accredited Investors

Non-accredited investors have only recently been allowed to invest in real estate crowdfunding and until August 2016, I’ve only been aware of one real estate crowdfunding website that has allowed non-accredited investors to invest in real estate crowdfunding, and that’s Fundrise.com. Let me know in the comments section below if you know of others. Fundrise.com offers the non-accredited investor two options, an Income REIT and a Growth REIT, both of which we’ll discuss more below.

Real estate crowdfunding just got a little bit more interesting for the non-accredited investor. In August 2016 RealtyMogul entered the playing field and offered a REIT that is also available to non-accredited investors. This is a great development for non-accredited investors who want to participate in real estate crowdfunding opportunities. I have been considering investing in one or both of the Fundrise REITs, so I was thrilled when RealtyMogul announced that they were also launching a REIT that is available to non-accredited investors. I like options! Lets review these REITs and decide if they look like good investments. Continue reading…

Accredited Investor Requirements and Non-Accredited Investor Restrictions In Real Estate Crowdfunding

To invest in most of the real estate crowdfunding platforms you need to be an accredited investor. There are a few platforms that allow individuals to investment if they are non-accredited investors, but those carry restrictions (they’re not too bad). This post will be a quick review of what it takes to qualify as an accredited investor and what your limitations are if you are a non-accredited investor.

Accredited Investor Definition

According to the SEC (Securities and Exchange Commission), an accredited investor is someone who either Continue reading…

Introduction

Real estate has always caught my attention. After graduating college with a degree in aerospace engineering, I moved to Denver in 1999 to start my first real job. At the time, I knew very little about real estate investing other than real estate was a good investment. I heard about people growing their real estate empire by buying a property and moving into it, and then a few years down the road buying another property, moving into the second property, and turning the first property into a rental. I thought this was a great idea. One year later I bought my first property and my real estate investing empire had begun.

Continue reading…