The rental market is a soft market. What I mean by that is there is no set market rental price like there is with commodities or the stock market. If “market rent” for your rental is $1,000/month, someone with a nearly identical property may be renting their property for $800/month and someone else might be renting their property for $1,200/month. Both will rent. The difference is, someone who is asking $800/month for their property will probably fill their property with tenants more quickly than someone who is asking $1,200/month for their property, assuming the properties are nearly identical. But the higher your asking price, the less likely you are to find tenants willing to pay your exorbitant price. What if I told you a way you can double your return on investment on your rental properties?

The rental market is a soft market. What I mean by that is there is no set market rental price like there is with commodities or the stock market. If “market rent” for your rental is $1,000/month, someone with a nearly identical property may be renting their property for $800/month and someone else might be renting their property for $1,200/month. Both will rent. The difference is, someone who is asking $800/month for their property will probably fill their property with tenants more quickly than someone who is asking $1,200/month for their property, assuming the properties are nearly identical. But the higher your asking price, the less likely you are to find tenants willing to pay your exorbitant price. What if I told you a way you can double your return on investment on your rental properties?

Is there a catch?

There is a catch. You need to have equity in your rental property, and you have to tap into that equity and reinvest it. You can do this in one of two ways without actually selling your property.

You can refinance your property and take equity out in the form of cash and reinvest that cash into something else. The positive side of doing this is that you get to lock in a low interest rate on the money you pull out of your rental property over a long period of time. The negative is that you are stuck paying a higher mortgage until the mortgage is fully paid off. And you may not be able to immediately invest all the money you pull out, so you will be paying interest on money you’ve borrowed but haven’t invested yet.

You can get a Home Equity Line of Credit (HELOC) on your rental property. Investment property HELOCs are typically given by your local bank. You just have to do an internet search and call around to find a bank in your area that offers a HELOC on an investment property. The positive side of getting a HELOC is you only pay interest on the money you use. You can take money out when you need it and put it back when you don’t. The negative side of HELOCs is they are typically variable rate loans. When interest rates rise, so do the rates on your HELOC. I personally prefer to use HELOCs.

Whether you you refinance your investment property to pull money out or get a HELOC, most banks will let you go to 75% combined loan-to-value on your property, meaning the sum of all mortgages on the property, including the HELOC, cannot be more than 75% of the value of the investment property.

How To Double The Return On Investment Of Your Rental Properties

I’m going to tell you what you could do to more than double the return on investment of your investment property using one of my properties as an example.

An investment property I bought 16 years ago currently has a mortgage of about $80,000. Its worth about $175,000. The current cash flow before taxes is about $400/month after all expenses (principle, interest, property taxes, insurance, maintenance, a vacancy allowance, and HOA). At 75% combined loan-to-value, I could get a HELOC for approximately $50,000 at a 4.5% interest rate.

I could use the $50,000 HELOC for a down payment for a similar property, but the mortgage would be much higher than $80,000 and the cash flow would only be about $100/month from the second rental property.

If you are an accredited investor, you have more options. I invested in a 400 unit apartment complex via real estate crowdfunding. The monthly cash-on-cash return is expected to be over 12% with an internal rate of return (IRR) over 25%. The investment is expected to mature after 3 years. During the three year hold period, the 12% return will come from the operating cash flow of the property. The principle investors will be making capital improvement to all the units in the property. They will raise rents on each unit after it is improved. With higher rents, the apartment complex will be worth significantly more. Their goal is to then sell it for substantially more than what they originally paid for the property. Upon sale of the apartment complex, I will receive a portion of the profits from the sale. The return from cash flow plus the return from the sale of the apartment complex is expected to yield an annual return of 25% over the three year hold period. A 25% return on my $50,000 investment equates to just over $1,040 per month. But we still have to subtract the HELOC interest payment during the three year hold period.

As discussed earlier, the HELOC interest rate is variable, and as the Federal Reserve raises interest rates, the rate on my HELOC will also rise. Current expectations are that the Fed will raise rates approximately 3% over the next 3 years. This means that the rate on my HELOC will gradually rise from 4.5% to 7.5% by the end of the 3 year hold period. The average is 6%. The cost of 6% on $50,000 is $250/month.

The net profit from this real estate crowdfunded investment is $790/month ($1040 – $250). By tapping into the equity on my investment property with a HELOC and investing in real estate crowdfunding, I’ve turned a property that cash flows $400/month into a property that cash flows $1,190/month without using any additional capital out of pocket. High five me!

Are There Risks?

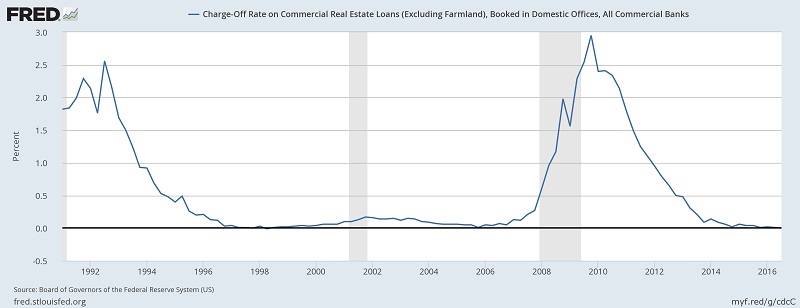

By tapping into my investment property equity, I’m increasing my leverage which is increasing my risk. The worst case scenario is the principle investors completely flop and I lose 100% of my investment. But in today’s market, that is highly unlikely, as indicated by the chart below.

The chart shows the rate at which a bank loses money on commercial real estate loans, which would equal the rate in which an equity investor investing in commercial real estate crowdfunding would lose 100% of their investment. It doesn’t show the likelihood that the investment will achieve its goal or the likelihood that I will even get back all of my principle investment, but it is an indicator of the general health of the commercial real estate market. Right now appears quite healthy. Considering the upside reward of nearly 3x-ing my rental property returns vs. the downside risk, I was willing to take the risk. Are you?